Are you someone who loves solving real-world business challenges? Do you want to experience how global financial operations work at one of the world’s biggest companies? If yes, then here’s some great news for you!

- About Amazon

- Amazon International Tax Compliance Internship 2025 – Key Highlights

- Why Choose the Amazon Internship?

- Roles and Responsibilities

- Eligibility Criteria

- How to Apply for Amazon Internship 2025

- Internship Benefits

- Related Posts

- FAQs on Amazon International Tax Compliance Internship

- Why This Internship Matters

- Final Thoughts

Amazon has officially announced its International Tax Compliance Internship under the APAC ITX Compliance division. This is a golden opportunity for finance, commerce, and accounting students who aspire to work with a global industry leader while learning from top professionals.

This internship not only helps you gain hands-on experience in international taxation but also gives you a chance to work in a fast-paced, innovative, and global environment where learning never stops.

Let’s explore everything you need to know about the Amazon International Tax Compliance Internship 2025, including eligibility, benefits, responsibilities, and how to apply.

About Amazon

Amazon, founded by Jeff Bezos, is one of the largest multinational technology companies, specializing in e-commerce, cloud computing, AI, and logistics. Beyond being a global marketplace, Amazon operates in over 200 countries, handling complex financial and tax systems that ensure compliance with local and international regulations.

The Amazon APAC ITX (International Tax Compliance) team works to ensure that the company’s business operations align with regional tax laws and international accounting standards.

This internship is designed for students who want to develop their skills in international finance, taxation, accounting, and compliance while learning from one of the most successful corporate teams in the world.

Amazon International Tax Compliance Internship 2025 – Key Highlights

| Internship Details | Description |

|---|---|

| Company Name | Amazon |

| Internship Role | International Tax Compliance (APAC ITX) |

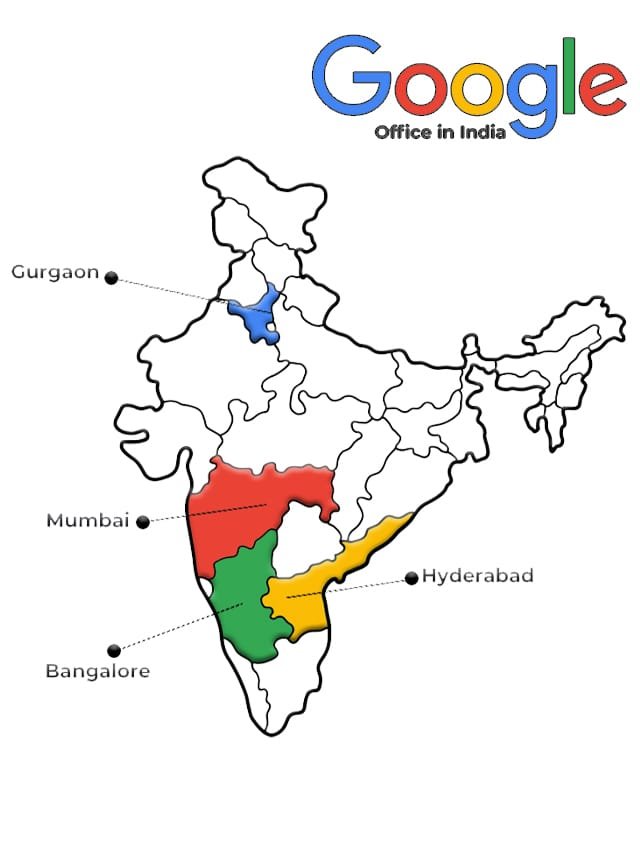

| Location | APAC Region (primarily India) |

| Mode | Hybrid/Office (depending on role) |

| Duration | 3 – 6 Months |

| Stipend | Competitive and as per company standards |

| Eligibility | Students pursuing B.Com, M.Com, CA Inter, or related fields |

| Certificate | Yes, on successful completion |

| Application Deadline | Open for a limited period |

| Experience Level | Freshers / Final-year students |

Why Choose the Amazon Internship?

Working at Amazon gives you exposure to how large-scale businesses handle global taxation and compliance across multiple regions. Here’s why this opportunity stands out:

- Work on International Projects – Gain experience working with professionals across countries and time zones.

- Professional Mentorship – Learn from senior tax and finance experts at Amazon.

- Real-World Problem Solving – Contribute to financial data management and compliance processes.

- Stipend & Certification – Earn while you learn, and receive an internship certificate from Amazon.

- Career Growth – Get exposure to career paths in taxation, financial analysis, and compliance.

This internship is ideal for those who want to combine finance, technology, and business analytics in one professional role.

Roles and Responsibilities

As an International Tax Compliance Intern at Amazon, you will be working on tasks that ensure compliance with various tax laws and regulations. Some of your responsibilities include:

- Supporting APAC ITX Compliance Team in tax filings, audits, and documentation.

- Assisting in data analysis and tax reporting using internal tools and systems.

- Collaborating with cross-functional teams like accounting, treasury, and operations.

- Helping in reconciliation and verification of tax-related data across entities.

- Performing research on tax laws and compliance requirements in different countries.

This role provides real corporate exposure and helps you understand the financial backbone of a global company.

Eligibility Criteria

The Amazon International Tax Compliance Internship 2025 is open to students and freshers who meet the following qualifications:

- Pursuing or completed Bachelor’s or Master’s degree in Commerce, Accounting, Finance, or Taxation.

- Strong understanding of financial principles and tax laws.

- Proficiency in Excel, data analysis tools, and accounting software.

- Good communication and analytical skills.

- Ability to work independently and handle confidential data.

If you are currently pursuing CA Inter or MBA (Finance), this internship is a perfect stepping stone to your career in finance and compliance.

How to Apply for Amazon Internship 2025

Follow these steps to apply for the Amazon International Tax Compliance Internship 2025:

- Visit the Amazon Careers official website.

- Search for “International Tax Compliance Internship – APAC ITX”.

- Go through the job description and verify your eligibility.

- Click “Apply Now”, fill in your academic details, and upload your resume.

- Submit your application before the deadline.

After applying, shortlisted candidates will be contacted via email for the next steps, which may include assessments or virtual interviews.

Internship Benefits

Here’s what makes the Amazon internship program a great opportunity:

| Benefit | Description |

|---|---|

| Global Exposure | Work with international teams across the APAC region |

| Skill Enhancement | Develop knowledge in finance, taxation, and compliance |

| Mentorship | Guidance from experienced professionals |

| Certification | Official internship certificate from Amazon |

| Networking | Build connections with industry leaders |

Related Posts

- IIT Roorkee Internship 2026 Research Stipend

- SP Global Internship 2026 Summer Roles Gurugram

- Kotak Internship 2026 Recruitment Role Mumbai

- Deutsche Bank Internship 2026 CFO Role

- Justdial Internship 2026 HR Role With Stipend

FAQs on Amazon International Tax Compliance Internship

Q1. Is this internship paid?

Yes, Amazon offers a competitive stipend to its interns based on company policies and role responsibilities.

Q2. Is this internship open to all students?

It’s primarily for commerce, finance, and accounting students, but candidates from related fields may also apply.

Q3. What skills do I need for this internship?

You should have knowledge of accounting principles, data management, and tax concepts, along with strong Excel skills.

Q4. Can I apply from outside India?

Yes, since this is an APAC ITX role, applicants from multiple Asia-Pacific countries can apply.

Q5. Will I receive a certificate after completion?

Yes, all interns receive an Amazon internship certificate upon successful completion of the program.

Why This Internship Matters

The Amazon International Tax Compliance Internship 2025 isn’t just another internship—it’s a career accelerator. You’ll learn how one of the world’s most influential companies handles complex tax and financial operations, giving you an edge in your professional journey.

This opportunity is particularly valuable for students looking to explore corporate finance, accounting, and global compliance, while working with a brand trusted worldwide.

Final Thoughts

If you’re passionate about finance, accounting, and international compliance, this Amazon internship could be your gateway to an exciting global career. You’ll gain practical experience, work on impactful projects, and receive a certificate from one of the most recognized companies in the world.

So, don’t miss this chance! Apply soon and take your first step toward becoming a global financial professional with Amazon.

Closing Note

Thank you for reading this article on CourseBhai.com.

To stay updated on the latest free courses, internships, and job opportunities, make sure to follow Course Bhai on social media, enable push notifications, and subscribe to our newsletter.

Stay connected — your next career breakthrough might just be a click away!

![Nestle Nesternship Internship Program 2025 [Certificate; Amazon Vouchers; GOLDEN TICKET] Apply Today 3 Nestle Nesternship Internship Program 2025 [Certificate; Amazon Vouchers; GOLDEN TICKET] Apply Today](https://coursebhai.com/wp-content/uploads/2025/10/Untitled-1200-x-628-px-2025-10-28T173935.462.png)

![Free Adobe Apprenticeship Program | 2025-26 [Monthly Stipend Rs. ₹35,000 INR] Apply Fast 9 Free Adobe Apprenticeship Program | 2025-26 [Monthly Stipend Rs. ₹35,000 INR] Apply Fast](https://coursebhai.com/wp-content/uploads/2025/10/Untitled-1200-x-628-px-2025-10-29T170831.005-330x220.png)